News

The paper on Post-disaster Business Recovery Susceptibility to Financial Conditions was prepared by Dr. Huan Liu, Program-Specific Assistant Professor, Disaster Prevention Research Institute, Kyoto University for GADRI Actions, December 2022 edition.

1. Introduction

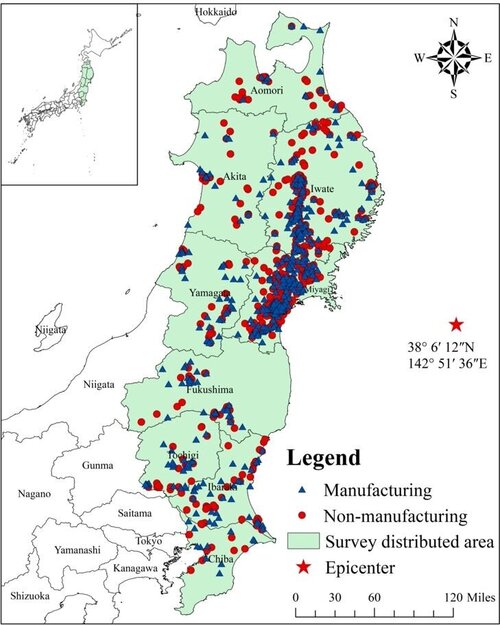

Businesses play an important role in local economies, but they are highly vulnerable to disasters and face significant challenges in mitigating them. At the same time, businesses face significant constraints regarding access to finance in the aftermath of disasters, exacerbating their financial vulnerability. Therefore, understanding, managing, and reducing the financial and fiscal impacts of natural disasters on businesses can effectively enhance post-disaster response and achieve "building back better" in recovery, rehabilitation, and reconstruction. However, due to the complexity of the post-disaster recovery process and data limitations, little evidence has been provided on how business financial status affects the post-disaster recovery from the individual firm perspective, especially the effect on different size firms. In this regard, this paper discusses the role of financial status in post-disaster recovery and provides empirical evidence of how financial status influences business recovery using 2052 firms' post-disaster recovery data after the 2011 Great East Japan Earthquake. It is worth mentioning that this paper is an extension of the discussion of the journal paper "Modeling Post-disaster Business Recovery under Partially Observed States: A Case Study of the 2011 Great East Japan Earthquake" published by Huan Liu, Hirokazu Tatano, Yoshio Kajitani, and Yongsheng Yang in the Journal of Cleaner Production in 2022 [1]. This paper provides unique insight into the challenges of financing vulnerable industrial sectors, including the unique challenges of how governments use capital markets to finance building back better and sustainable developments. In Section 2, the case study and post-disaster data description are presented, as well as the reasons that caused financial difficulties in firms. In Section 3, the recovery curves under different financial statuses in industrial sectors are presented and compared using the case study data. Specifically, to investigate the heterogeneity of business size for financial difficulties, we further compared the recovery curves in Small and Medium Enterprises (SMEs) and large businesses under different financial difficulties. The conclusions and potential policy implications are discussed in Section 4.

Figure 1. The spatial distribution of samples in this research